06 Sep 2009

Capitalism: A Love Story

Michael Moore comes home to the issue he's been examining throughout his career: the disastrous impact of corporate dominance on the everyday lives of Americans (and by default, the rest of the world).

The first in-depth look at the GameStop cultural phenomenon and its impact on everyday investors. Hear from Mark Cuban, Jim Cramer, Dave Portnoy and Robinhood’s Vlad Tenev on this high-stakes saga.

Self

Self

Self

Self

Self

Self

06 Sep 2009

Michael Moore comes home to the issue he's been examining throughout his career: the disastrous impact of corporate dominance on the everyday lives of Americans (and by default, the rest of the world).

30 Mar 2018

An unsettling and eye-opening Wall Street horror story about Chinese companies, the American stock market, and the opportunistic greed behind the biggest heist you've never heard of.

08 Oct 2010

A film that exposes the shocking truth behind the economic crisis of 2008. The global financial meltdown, at a cost of over $20 trillion, resulted in millions of people losing their homes and jobs. Through extensive research and interviews with major financial insiders, politicians and journalists, Inside Job traces the rise of a rogue industry and unveils the corrosive relationships which have corrupted politics, regulation and academia.

01 Jan 2009

Plunder: The Crime of Our Time is a hard-hitting investigative film by Danny Schechter. The "News Dissector" explores how the financial crisis was built on a foundation of criminal activity uncovering the connection between the collapse of the housing market and the economic catastrophe that followed.

06 Oct 2021

The computer game chain GameStop created so much chaos in the stock market that it forced large hedge funds to their knees. How could it happen? Here we follow different people who were brought together during 2020 because of their interest in GameStop's future. Some had invested in the chain's stock, others wondered about it. While the chain's employees trusted that the company would pay their salaries at a time when millions of people went bankrupt and became unemployed.

22 Apr 2005

A documentary about the Enron corporation, its faulty and corrupt business practices, and how they led to its fall.

28 Jan 2022

From the makers of Console Wars comes the origin story of the GameStop stock market phenomenon, featuring exclusive access to the original players who lit the fuse on a historic amateur investor uprising. Spotlighting the human side of a sensational business drama, this documentary is a David vs Goliath tale about ordinary people waking up to the power they have in numbers.

13 Apr 2012

Just days before Bernard Madoff captured headlines as the largest Ponzi schemer in U.S. history, Marc Dreier, a prominent Manhattan attorney, was arrested for orchestrating a massive fraud scheme that netted hundreds of millions of dollars from hedge funds. Brazen forgeries and impersonations branded the white collar crime spree remarkable. "Unraveled" is set in the purgatory of house arrest -- an Upper East Side penthouse -- where the Court has ordered Dreier confined until his sentencing day. The film weaves Dreier's struggle to prepare for the possibility of life imprisonment with first-person flashbacks, which reveal his audacious path of destruction. Destroyed by his own hubris, Dreier attempts to grasp his tragic unraveling. With unprecedented access, "Unraveled" exposes a mastermind of criminal deception.

02 May 2009

“I don’t think most people really understood that they were in a casino” says award-winning financial reporter Mark Pittman. “When you’re in the Street’s casino, you’ve got to play by their rules.” This film finally explains how and why over $12 trillion of our money vanished into the American Casino.

01 Jan 2009

A documentary exploring the causes of the 1929 Wall Street Crash.Over six terrifying, desperate days in October 1929, shares crashed by a third on the New York Stock Exchange. More than $25 billion in individual wealth was lost. Later, three thousand banks failed, taking people's savings with them. Surviving eyewitnesses describe the biggest financial catastrophe in history.

05 Apr 2009

Ripped Off: Madoff and the Scamming of America tells Madoff's story superbly, although it was put together before Madoff was sentenced to 150 years in prison without parole, so it's not quite complete—perhaps when he gets out, he can watch this DVD and fill in any gaps. There's a little bit of sensationalism here and there (and really, how could there not be? The man stole $65 billion!), but for the most part it's surprisingly levelheaded and, yes, even historical.

21 Jan 2011

The story of the credit bubble that caused the financial crash. Through interviews with some of the world's leading economists, including housing expert Robert Shiller, Nobel laureate Joseph Stiglitz, and economic historian Louis Hyman, as well as Wall Street insiders and victims of the crash including Ed Andrews - a former economics correspondent for The New York Times who found himself facing foreclosure - and Andrew Luan, once a bond trader at Deutsche Bank now running his own Wall Street tour guide business, the film presents an original and compelling account of the toxic combination of forces that nearly destroyed the world economy.

27 Feb 2003

A 2003 documentary film about women on Wall Street following the lives of four Wall Street women - a research analyst, a currency trader, an NYSE floor broker and a rookie investment banker.

16 May 2010

On 11th January 2008, hired by the City of Cleveland, lawyer Josh Cohen and his team filed a lawsuit against 21 banks, which they held accountable for the wave of foreclosures that had left their city in ruins. Since then, the bankers on Wall Street have been fighting by with all available means to avoid going to court. This film is the story of that trial. A film about a trial that may never be held but in which the facts, the participants and their testimonies are all real: the judge, lawyers, witnesses, even the members of the jury - asked to give their verdict - play their own roles. Step by step, one witness after another, the film takes apart, from a plain, human perspective, the mechanisms of subprime mortgage loans, a system that sent the world economy reeling. A trial for the sake of example, a universal fable about capitalism

24 Nov 2014

MARTIN ARMSTRONG, once a US based trillion dollar financial adviser, used the number pi to predict economic turning points with precision. When some big New York bankers asked him to join the club to help them to take over Russia, he refused to join the manipulation. A few days later the FBI stormed his offices accusing him of a 3 billion dollar Ponzi Scheme - an attempt to stop him talking about the real Ponzi Scheme of debts that the US has build up over the years and which he thinks starts to collapse after October 1, 2015, a mayor pi turning point he is predicting.

19 Nov 2010

A look at how one investigator spent ten years trying to expose Bernie Madoff's massive Ponzi scheme that scammed an estimated $18 billion from investors.

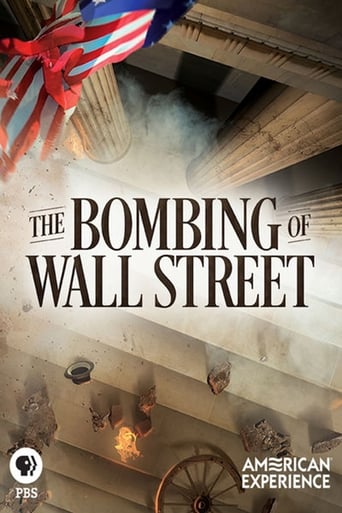

13 Feb 2018

On September 16, 1920, as hundreds of Wall Street workers headed out for lunch, a horse-drawn cart packed with dynamite exploded in front of Morgan Bank — the world’s most powerful banking institution. The blast turned the nation’s financial center into a bloody war zone and left 38 dead and hundreds more seriously injured. As financial institutions around the country went on high alert, many wondered if this was the strike against American capitalism that radical agitators had threatened for so long.

01 May 2012

97% owned present serious research and verifiable evidence on our economic and financial system. This is the first documentary to tackle this issue from a UK-perspective and explains the inner workings of Central Banks and the Money creation process. When money drives almost all activity on the planet, it's essential that we understand it. Yet simple questions often get overlooked, questions like; where does money come from? Who creates it? Who decides how it gets used? And what does this mean for the millions of ordinary people who suffer when the monetary, and financial system, breaks down? Produced by Queuepolitely and featuring Ben Dyson of Positive Money, Josh Ryan-Collins of The New Economics Foundation, Ann Pettifor, the "HBOS Whistleblower" Paul Moore, Simon Dixon of Bank to the Future and Nick Dearden from the Jubliee Debt Campaign.

29 Apr 2015

No overview found

01 Jan 2009

Thursday, October 24 : the Wall Street Stock Exchange crashes, the greatest economic crisis of the 20th century suddenly breaks out. Fueled by the idea that everyone can get rich without limits, it puts a final stop to the euphoria of the 1920s. America is then caught in a devastating cycle which spreads around the world a few months later like a malign infection. Calling on renowned historians and economists, William Karel conducts an incredibly detailed analysis of the economic and financial mechanisms that lead to the crash of Wall Street and then to the Great Depression of the 1930's.